Ever feel like your salary slips away before you can save a rupee? The 50-30-20 budgeting rule is a simple, effective way to manage your money in India’s high-cost environment. It divides your income into needs, wants, and savings, ensuring you live well while building wealth. Ready to take control of your finances? Let’s break down the 50-30-20 rule and make it work for you!

What is the 50-30-20 Rule?

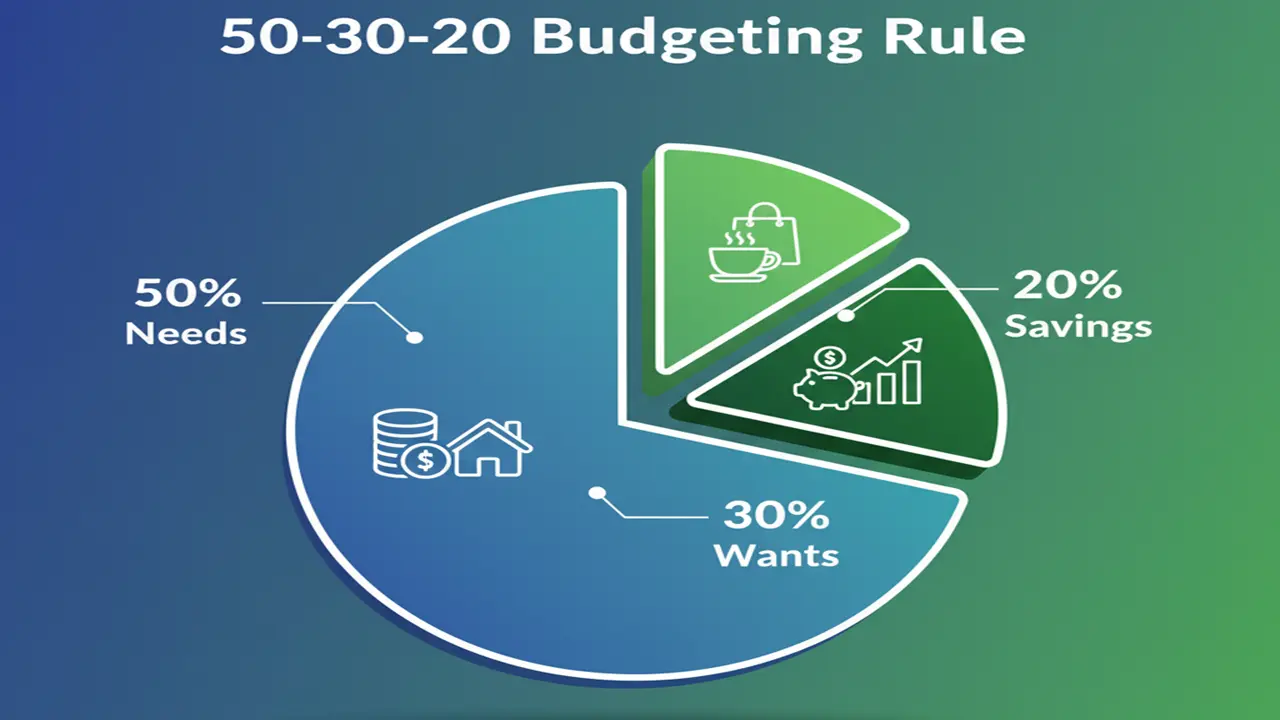

The 50-30-20 rule allocates 50% of your after-tax income to needs, 30% to wants, and 20% to savings or debt repayment. It’s a flexible framework that balances essentials, enjoyment, and financial goals. Priya, a Mumbai teacher, uses it to manage her salary, saving for a vacation while covering rent. This rule simplifies budgeting, making it ideal for India’s diverse earners.

Why Use the 50-30-20 Rule?

This rule promotes discipline without feeling restrictive. It ensures essentials are covered, lets you enjoy life, and prioritizes wealth-building. Ankit, a Delhi engineer, saved ₹10,000 monthly using this method, funding an emergency account. It’s beginner-friendly, adaptable to any income, and works with financial apps to track spending. In India’s rising cost-of-living scenario, it’s a practical path to financial stability.

Step 1: Calculate Your After-Tax Income

Determine your monthly take-home income after taxes and deductions. Neha, a Bengaluru freelancer, earns ₹50,000 post-tax from her gigs. Include only reliable income, not irregular bonuses. Use bank statements or financial apps to confirm your net income. This figure is the foundation of your 50-30-20 budget, guiding how much you allocate to each category.

Step 2: Allocate 50% to Needs

Assign 50% of your income to essentials—rent, groceries, utilities, transport, and EMIs. Rohan, a Chennai entrepreneur, spends ₹25,000 of his ₹50,000 income on rent and bills. Include health insurance and minimum debt payments here. If needs exceed 50%, cut variable costs like dining out. Financial apps help track these expenses, ensuring you stay within limits.

Step 3: Allocate 30% to Wants

Dedicate 30% to non-essentials—dining, entertainment, or hobbies. Shalini, a Hyderabad nurse, budgets ₹12,000 for movies and shopping from her ₹40,000 income. Wants add joy but must be controlled to avoid overspending. Use cash or financial apps to set spending caps. This category lets you enjoy India’s vibrant lifestyle without derailing financial goals.

Step 4: Allocate 20% to Savings and Debt Repayment

Reserve 20% for savings or paying off high-interest debts like credit cards. Meera, a Kolkata shop owner, saves ₹8,000 monthly in an RBI-regulated account and SEBI-regulated SIPs. Prioritize an emergency fund (3-6 months’ expenses) and investments like mutual funds. Use the debt avalanche method for faster repayment, focusing extra funds on high-interest loans.

Step 5: Track and Adjust Your Budget

Monitor your spending monthly using financial apps or spreadsheets. Ravi, a Pune driver, noticed his dining costs crept into savings, so he adjusted his budget. Review income changes, like a raise, to reallocate funds. Flexibility is key—tweak wants or non-essential needs if expenses shift. Regular tracking ensures the 50-30-20 rule keeps your finances on track.

Step 6: Automate Savings and Investments

Set up auto-transfers to RBI-regulated savings accounts or SEBI-regulated mutual fund SIPs on payday. Priya auto-debits ₹5,000 monthly to her emergency fund, ensuring consistency. Automation prevents spending temptations, prioritizing savings. Start with small amounts if 20% feels tough, scaling up over time. Financial apps simplify setup, making wealth-building effortless in India’s busy lifestyle.

Step 7: Choose Safe Investment Options

Invest your 20% savings in SEBI-regulated mutual funds or RBI-regulated fixed deposits for growth. Ankit’s ₹10,000 monthly SIP in an equity fund builds his retirement corpus. PPF or ELSS under Section 80C offer tax savings. Research options on financial websites to match your risk tolerance. Diversify across equity and debt to balance safety and returns.

Step 8: Manage High-Cost Needs

If needs exceed 50%—common in cities like Mumbai—cut variable expenses like dining or subscriptions. Neha switched to public transport, saving ₹3,000 monthly. Negotiate bills, like internet plans, or share costs with roommates. Financial apps highlight overspending areas. Trimming wants or finding cheaper alternatives ensures your budget aligns with the 50-30-20 framework.

Step 9: Boost Income for Flexibility

If saving 20% is tough, increase income through side hustles—freelancing, tutoring, or online gigs. Rohan earns ₹5,000 extra monthly from content writing, boosting his savings. Platforms like Upwork or local tutoring networks offer opportunities. Direct extra income to SEBI-regulated SIPs or RBI-regulated accounts, making the 50-30-20 rule easier to follow.

Step 10: Build an Emergency Fund

Save 3-6 months’ expenses in an RBI-regulated savings account or SEBI-regulated liquid fund for crises. Shalini keeps ₹60,000 for emergencies, protecting her investments. Start with ₹1,000 monthly, automating transfers via financial apps. An emergency fund prevents dipping into savings or taking loans, ensuring your 50-30-20 budget supports long-term financial freedom.

Benefits of the 50-30-20 Rule

This rule balances necessities, enjoyment, and savings, reducing financial stress. Meera funded a vacation with her 20% savings. It’s adaptable to students, professionals, or retirees. SEBI-regulated investments and RBI-regulated accounts ensure safety. Financial apps make tracking easy, helping you save for goals like a home or retirement while enjoying India’s vibrant lifestyle.

Challenges to the 50-30-20 Rule

High living costs in cities or irregular income can strain the 50% needs limit. Ravi struggled with rent eating 60% of his income. Cut wants, like frequent dining, or boost income with side gigs. Financial apps help adjust budgets. Flexibility and discipline overcome these challenges, making the rule work for India’s diverse financial realities.

Tips for Success

Start with small savings if 20% feels tough. Use financial apps to set spending alerts. Review your budget monthly to stay on track. Priya shares her goals with family for accountability. Automate savings to SEBI or RBI-regulated accounts. Consult a SEBI-registered advisor to optimize investments, ensuring your 50-30-20 plan aligns with your financial dreams.

Common Mistakes to Avoid

Don’t ignore small expenses; coffee runs add up. Neha overspent on wants, delaying savings. Avoid skipping savings to fund wants. Don’t use unregulated investment platforms; Ankit lost ₹10,000 to a scam. Stick to SEBI or RBI-regulated options. Don’t set an unrealistic budget—adjust percentages if needs exceed 50% to maintain balance.

Conclusion

The 50-30-20 rule is a simple, powerful way to manage money in India. Allocate 50% to needs, 30% to wants, and 20% to savings or debt repayment. Use financial apps, automate savings, and invest in SEBI or RBI-regulated options. Stay flexible and disciplined to achieve your goals. Ready to try it? Share your budgeting plan in the comments and start building wealth!

Frequently Asked Questions (FAQ)

What is the 50-30-20 rule?

It allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment.

Can I use it with a low income?

Yes, start with small savings and boost income with side hustles to meet the 20% goal.

How do I track my budget?

Use financial apps or spreadsheets to monitor spending and stay within limits.

What if my needs exceed 50%?

Cut wants or non-essential needs, like dining out, and use financial apps to adjust.

Where should I invest my savings?

Choose SEBI-regulated mutual funds or RBI-regulated FDs for safe, long-term growth.